Last updated September 27, 2024 by Sharlyn Lao

Social Security System (SSS) plays a vital role in providing financial protection and benefits to millions of workers and their families. As we step into 2024, it's essential for both employees and employers to understand how to accurately calculate monthly contributions to ensure compliance and maximize the benefits offered by this crucial social safety net. This blog post will guide you through the process of calculating your SSS monthly contribution, taking into account the new regulations and any changes that may be implemented this year.

Understanding the Basics: What is SSS

Social Security System (SSS) is a government agency in the Philippines established to provide social security benefits to both private sector employees and self-employed individuals.

The SSS was created under Republic Act No. 1161. Its primary purpose is to provide social insurance to workers in the private sector, particularly in times of need such as retirement, disability, maternity, sickness, and death. The SSS operates through a system of contributions collected from both employees and employers, which are then pooled to fund the various benefits provided to members.

- To Provide Financial Security: The SSS aims to provide financial assistance to members during times of unemployment, illness, or other life events that may hinder their ability to earn a living.

- To Promote Savings: By requiring contributions, the SSS encourages members to save for their future, ensuring they have a financial cushion for emergencies and retirement.

- To Foster Social Justice: The SSS plays a crucial role in promoting social justice by helping those who are unable to support themselves due to unforeseen circumstances.

Mandatory Members That Contributes

Membership in the SSS is mandatory for several categories of workers, including:

- Private Sector Employers and Employees: All employers and employees in private companies are required to register with the SSS and contribute to the fund.

- Self-Employed Individuals: Self-employed individuals, such as freelancers, entrepreneurs, and professionals, must also register and contribute to the SSS.

- Overseas Filipino Workers (OFWs): OFWs are encouraged to become members of the SSS to ensure they can access benefits while working abroad.

- Voluntary Members: Individuals that are non-working spouses and individuals who have opted out of formal employment, can select their contribution amounts according to their financial means and preferred benefit level.

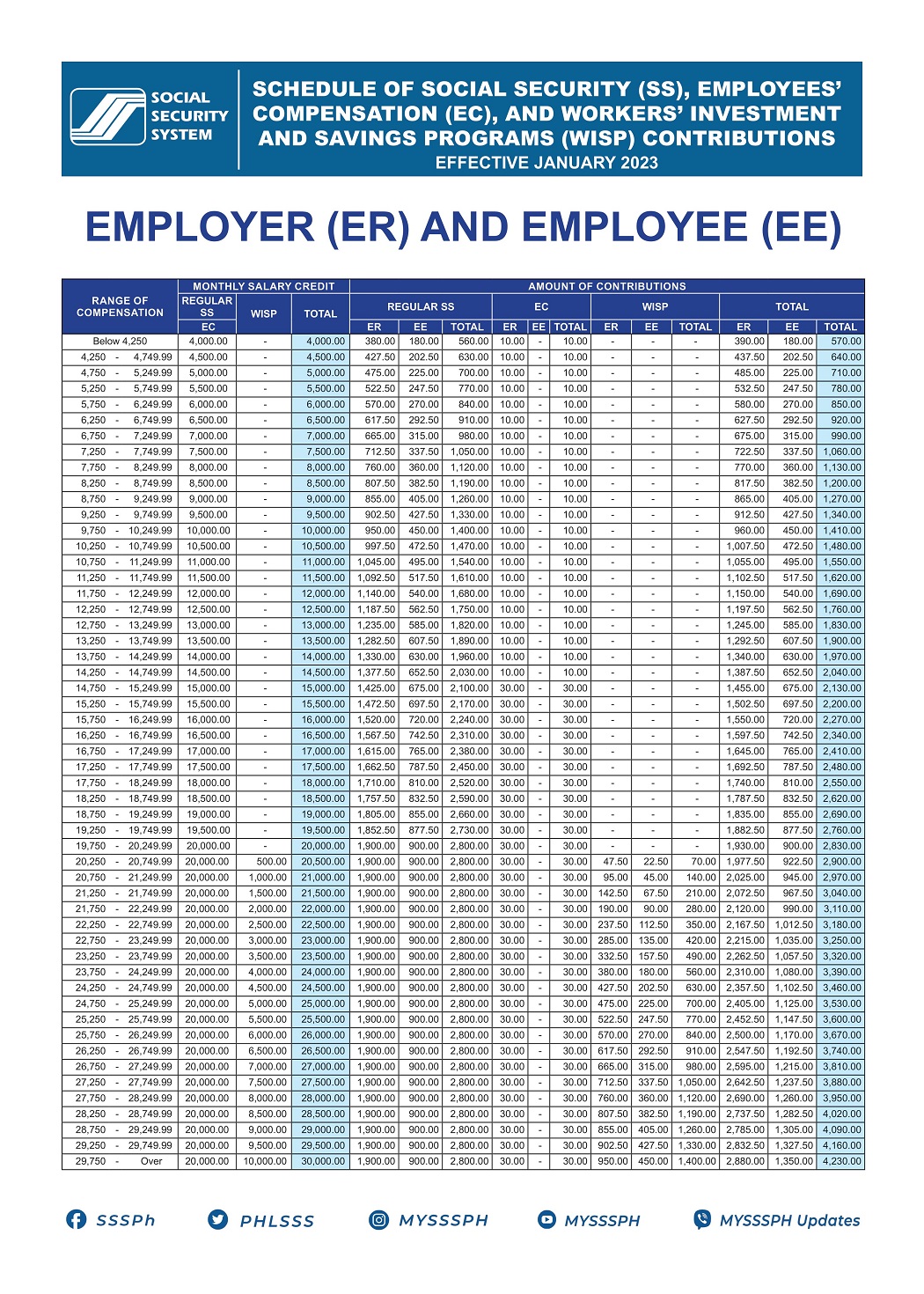

SSS Contribution Table for 2024

Note

This table only shows rates for the year 2024Calculate Your Contribution Based on Earnings

To calculate the SSS, first you must know your Monthly Salary Credit (MSC). Look for the bracket that your monthly income is in from the Range of Compensation column, then retrieve your MSC from under Monthly Salary Credit's Total column.

Next, identify your contribution amount:

- Employers must check the ER columns.

- Employees must check the EE columns.

Lastly, get the total monthly contribution from the rightmost Total column.

For example, James Doe of XYZ Company, receives a monthly income of P 15,000.00. Since he falls under the P 14,750 - P 15,249.99 bracket, his MSC is 15,000.00. His contributions are as follows.

Employer (ER) will pay = 1,425.00 + 30.00 (EC Contribution)

Employee (EE) will have deduction from income = 675.00

Therefore, James Doe's Monthly Contribution is P 2,130.00.

Alternatively you can use this formula to compute for your Monthly Contribution. For contribution rate, 9.5% are made by the employer, while employees contribute 4.5%, making a total of 14%.

Monthly Salary Credit x Contribution Rate

For example, John Doe of XYZ Company, receives a monthly income of P 20,000.00. His contributions are as follows.

20,000.00 x 14% = 2,800.00

2,800.00 + 30.00 (EC Contribution) = 2,830.00

Therefore, John Doe's Monthly Contribution is P 2,830.00.

Payment Schedules and Platforms

Your SSS membership type will determine your specific payment schedule:

- For regular employers: Payments are due on the last day of the next month. Therefore employers must remit contributions on behalf of their employees by the end of the following month.

- For self-employed members: Contributions must be submitted by the last day of the following month or quarter.

As for payment methods, individuals can choose to pay through over-the-counter methods or online

- Over-the-Counter Payments:

- SSS Branches: Members can make payments directly at any SSS branch across the Philippines. This method allows for immediate processing and confirmation of your contribution.

- Accredited Banks: Many banks in the Philippines are accredited by the SSS to accept contributions. Members can visit these banks to make payments over the counter. Some of the accredited banks include BDO, Metrobank, and Land Bank.

- Online Payment Options:

- My.SSS Portal: Members can log in to their My.SSS account to pay contributions online. This platform allows for a seamless payment process, enabling users to pay via debit or credit cards.

- Mobile Banking Apps: Many local banks offer mobile banking apps that allow users to pay their SSS contributions directly through their phones. Members should check with their respective banks for details on how to utilize this feature.

- E-Wallets: Popular e-wallets such as GCash and PayMaya provide options for paying SSS contributions. Members can link their SSS accounts and pay through these platforms, making it a convenient option for those who prefer digital transactions.

Skyrocket your payroll with JeonSoft

JeonSoft presents an all-encompassing solution that seamlessly integrates various functionalities into a complete package. This suite is designed for streamlined and effective processing, involving tasks ranging from employee record management to time attendance monitoring to payroll computation. Additionally, JeonSoft delivers a sophisticated timekeeping solution that empowers users to effortlessly clock in and out from any location, ensuring unparalleled convenience in workforce management. Want to know which product works best for you? Click the View Products button below.

Build a Better World One Paycheck at a Time

Take command of your payroll operations with JeonSoft Payroll systems, providing comprehensive solutions to optimize your payroll requirements. Whether your business expands or government regulations evolve, JeonSoft is the tool to effectively oversee and adapt to your needs.

View Products